Maximizing Your Retirement Savings: 401(k) Contribution Limits for 2023, 2024, and 2025

Table of Contents

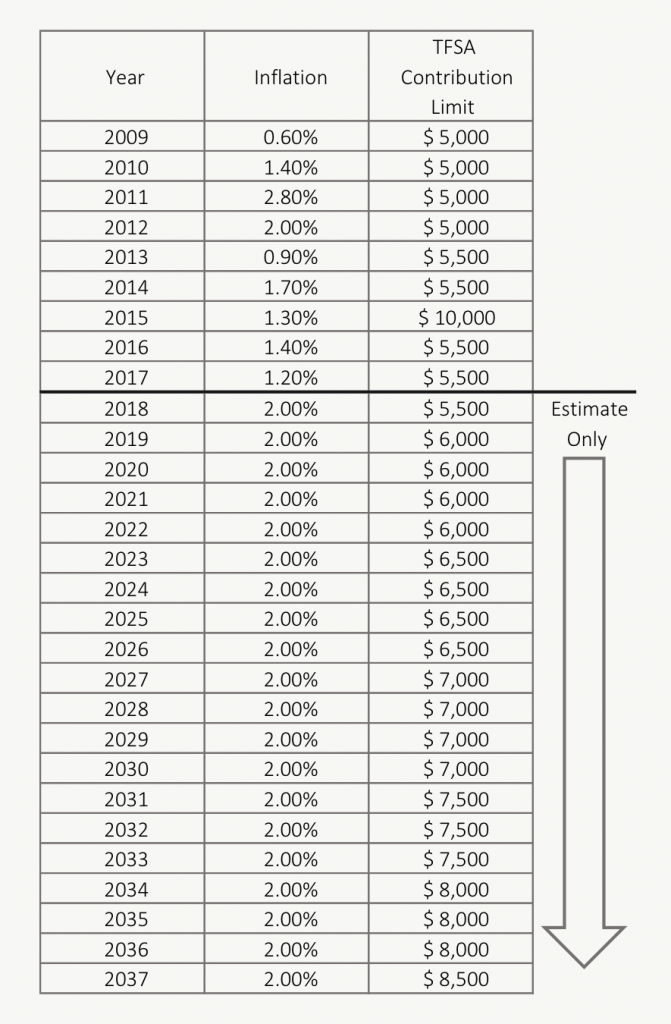

- 2024 Tfsa Maximum Contribution - Dede Monica

- New IRS Limits for 401k and IRA: Maximize Your Retirement Savings - YouTube

- Tax Changes You Should Know for 2024: 401(k) Limits, Tax Brackets and ...

- IRS Released 401(k) and IRA Contribution Limits for 2024 - Buy Side ...

- 2024 Tfsa Maximum Contribution - Dede Monica

- Tfsa 2024 Contribution Limit - Deeyn Evelina

- 401k Contribution Limits for 2024: Everything You Need to Know - Intuit ...

- 2021 Limits for IRAs, 401(k)s and More - The Financial Specialists

- Max Tfsa Contribution For 2024 Over 65 - Tatum Gabriela

- TFSA Limit 2024: All about TFSA Contribution Limit for year 2024

Understanding 401(k) Contribution Limits

401(k) Contribution Limits for 2023, 2024, and 2025

How to Maximize Your 401(k) Contributions with Fidelity

Fidelity is one of the largest and most reputable investment companies in the world, offering a range of retirement plans, including 401(k) plans. To maximize your 401(k) contributions with Fidelity, consider the following tips: Contribute enough to take full advantage of employer matching: If your employer offers a 401(k) matching program, contribute enough to maximize the match. This is essentially free money that can add up over time. Take advantage of catch-up contributions: If you're 50 or older, consider making catch-up contributions to boost your retirement savings. Automate your contributions: Set up automatic contributions to your 401(k) plan to make saving easier and less prone to being neglected. Review and adjust your investment portfolio: Regularly review your investment portfolio to ensure it's aligned with your retirement goals and risk tolerance. Maximizing your 401(k) contributions is an essential step in securing your retirement future. By understanding the 401(k) contribution limits for 2023, 2024, and 2025, and following the tips outlined above, you can make the most of your retirement plan with Fidelity. Remember to contribute enough to take full advantage of employer matching, take advantage of catch-up contributions, automate your contributions, and review and adjust your investment portfolio regularly. Start planning for your retirement today and ensure a more secure financial future.Related Topics: 401(k) plans, retirement savings, Fidelity, contribution limits, investment portfolio, employer matching, catch-up contributions.

Meta Description: Learn about the 401(k) contribution limits for 2023, 2024, and 2025, and discover how to maximize your retirement savings with Fidelity.

Keyword Density: 401(k) contribution limits (2.5%), Fidelity (1.8%), retirement savings (1.5%), investment portfolio (1.2%), employer matching (1%), catch-up contributions (0.8%).